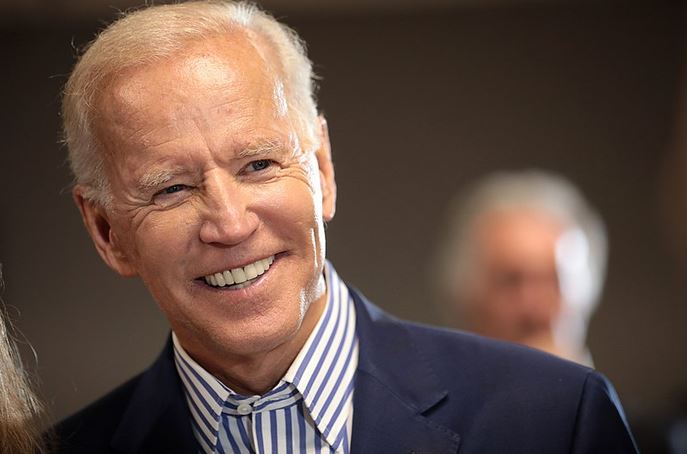

Inauguration Day is just months away. Many are wondering what President-Elect Joe Biden’s economic plans could mean long-term for the economy and their personal finances.

What we know for sure is that a Biden presidency will likely impact tax rates, stock prices, housing costs, healthcare prices, and more. Let’s take a look at each of those things and how they may impact your personal finances in 2021 and beyond.

Taxes

Biden has an ambitious agenda in changing taxes. He and his allies believe it will only impact the “wealthiest” of Americans. Biden has recommended raising the tax rate for these affluent Americans from 37% to 39.6%. Who he considers “wealthy” is up to some debate. According to Biden, the new rate would apply to those making over $400,000 per year. I wonder how many of those individuals actually consider themselves “wealthy?” That is a question for another blog. Corporations may also see a tax increase, as Biden intends to raise corporate tax rates from 21% to 28%. However, he believes that most “middle-class” Americans will benefit from his tax plan. But that remains to be seen.

The Pandemic

The incoming Biden-Harris administration has made it clear that on day one they will make getting an additional COVID-19 stimulus their priority. The president-elect has already begun building his COVID-19 task force. He and VP-elect Harris have made it clear throughout the campaign that the release of another big stimulus package for COVID-19 relief is high on their agenda. The new stimulus will fall under the HEROES Act. This proposal would provide another $1,200 in stimulus money for each family member, with a maximum of $6,000 per family. In addition, Biden’s plan intends to provide relief for Main Street businesses and entrepreneurs. He also plans to create millions of good-paying jobs ranging from public health roles to manufacturing positions. His “Build Back Better” plan would also provide local, state, and tribal governments with federal aid to help them avoid laying off essential workers, such as educators and firefighters.

Your Healthcare

Although the Supreme Court will ultimately impact the Affordable Care Act (Obamacare), Biden has an ambitious plan to modify it into Bidencare. This will add a public option that he says was always part of his and President Obama’s initial vision. Biden also intends to provide tax credits to help individuals afford their insurance premiums. Ideally, these credits would reduce health insurance costs to no more than 8.5% of a family’s earnings.

Higher Education

The Biden-Harris administration plans to cut the costs of higher education dramatically. This could lead to more Americans having the ability to attend college. Cornerstone is free or next to free tuition at public two-year colleges, particularly ones with vocational certifications that will allow students to graduate in a short amount of time with little or no debt and marketable skills.

Stocks and Investing

Changing political landscapes almost always results in stock market fluctuations, and the 2020 presidential election is no exception. Biden’s economic plans and presidency will impact the investment world, specifically influencing the prices of stocks. How wealthy Americans invest will sure change, as Biden’s tax plans call for increased taxes on capital gains.

Housing

His first initiative would provide $15,000 worth of these credits to Americans looking to put a down payment on a house. This would ease the financial burden that down payments often create. Biden also plans to increase federal rental aid and allocate $10 billion of federal spending toward rental housing for low-income earners. Biden’s ultimate goal is to see that no American pays more than 30% of their income toward their monthly housing costs. Look at your current monthly rent or mortgage, it is probably more than that.

Retirement

As part of his plan to make retirement more affordable for more Americans, Biden would like to see an increase in social security benefits for the poorest Americans. Biden also proposed to lower the minimum age to receive Medicare from 65 to 60. He also wants to offer $5,000 in tax credits for individuals who act as caregivers for their spouses or parents.

Do you think Joe Biden’s economic plans will help or hurt your personal finances?