This is one of those moments where spoon-feeding information just isn’t going to cut it. You have got to use the survey to see what the best possible insurance is for you to have. Why? Because not only do rates change from state to state, they change from zip code to zip code!

So instead of giving you a breakdown of every zip code in America, go ahead and finish filling out this survey. In the meantime, we can give you a brief rundown below.

DID YOU KNOW:

The internet has forever changed the auto insurance market? Before the internet, you’d have to use a broker to find quotes. Or, if you had a lot of energy, you could call a ton of different insurance companies to compare rates. Now it’s as easy as putting your zip code and email in this survey and PRESTO! All that grunt work that used to take you days to complete is now done in seconds!

The tables below show estimated average expenditures for private passenger automobile insurance by state from 2014 to 2018 and provide approximate measures of the relative cost of automobile insurance to consumers in each state. To calculate average expenditures, the National Association of Insurance Commissioners (NAIC) assumes that all insured vehicles carry liability coverage but not necessarily collision or comprehensive coverage. The average expenditure measures what consumers actually spend for insurance.*

Expenditures are affected by the coverages purchased as well as other factors. The NAIC does not account for policyholder classifications, vehicle characteristics, the amount of deductibles selected by the policyholder, differences in state auto and tort laws, rate filing laws, traffic conditions, and other demographic variables— all of which can significantly affect the cost of coverage. The NAIC notes that three variables—urban population, miles driven per number of highway miles, and disposable income per capita—are correlated with the state auto insurance premiums. It also notes that high-premium states tend to also be highly urban with higher wage and price levels, and greater traffic density. Many other factors can also affect auto insurance prices.

*Source: https://www.iii.org/fact-statistic/facts-statistics-auto-insurance

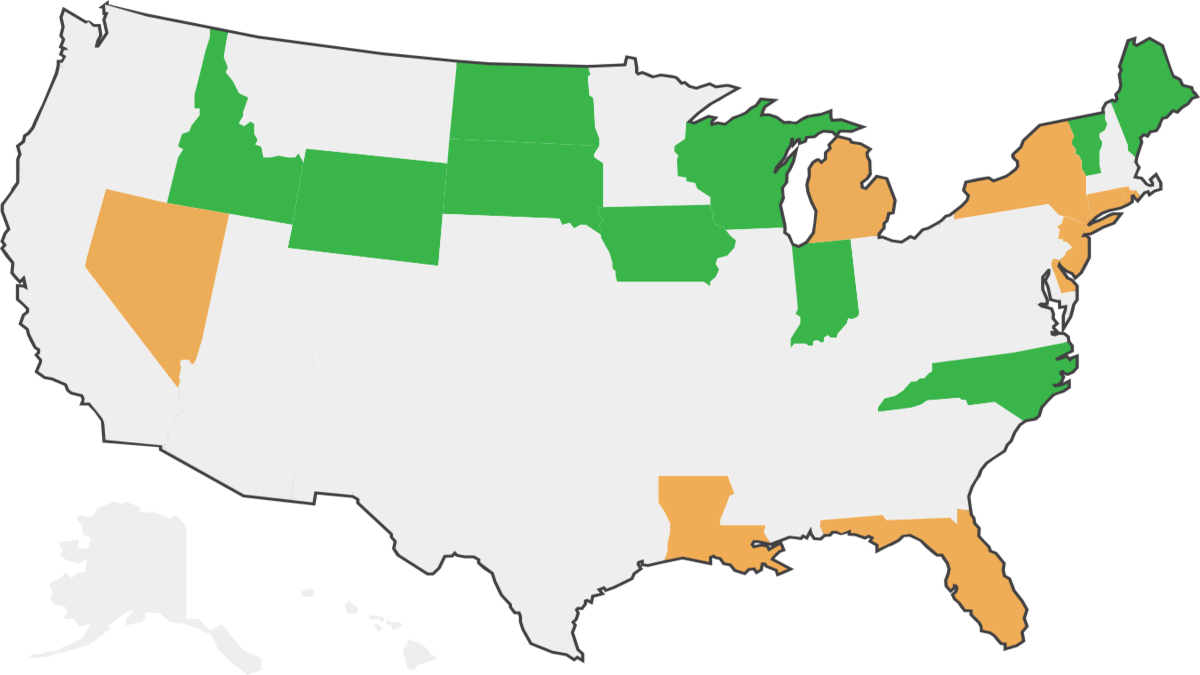

Top 10 Most Expensive And Least Expensive States For Auto Insurance, 2018

| Rank | Most expensive states | Average expenditure | Rank | Least expensive states | Average expenditure |

| 1 | Louisiana | $1,545.82 | 1 | North Dakota | $686.08 |

| 2 | Michigan | 1,469.73 | 2 | Maine | 686.25 |

| 3 | District of Columbia | 1,429.43 | 3 | Iowa | 700.71 |

| 4 | Florida | 1,426.46 | 4 | South Dakota | 721.67 |

| 5 | New York | 1,425.00 | 5 | Idaho | 722.06 |

| 6 | New Jersey | 1,385.61 | 6 | North Carolina | 734.06 |

| 7 | Rhode Island | 1,333.12 | 7 | Wisconsin | 755.97 |

| 8 | Delaware | 1,291.39 | 8 | Wyoming | 765.81 |

| 9 | Nevada | 1,260.43 | 9 | Indiana | 767.72 |

| 10 | Connecticut | 1,216.55 | 10 | Vermont | 778.29 |

Source: © 2021 National Association of Insurance Commissioners (NAIC).