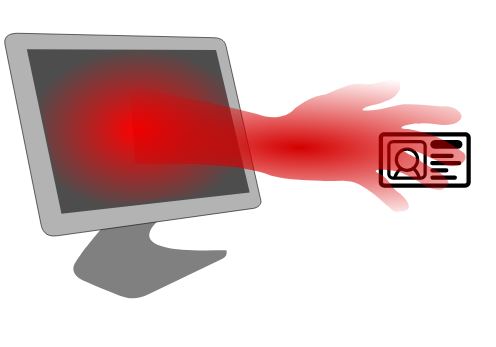

Among the carols, lights, and jingle bells, another thing you can be sure that comes around every Holiday Season is thieves and scammers. In fact, hackers and identity thieves are particularly active around the Holidays. You may have even already been the victim of Identity theft and not even know it. The impact of having your identity stolen could ruin your personal finances for years to come.

Have you been a victim? Here are the top 5 ways to tell if a thief has stolen your personal info and used it to take out loans or for other nefarious purposes.

1. Changes in your credit report

Today, it is quite easy to monitor your credit report. All the major consumer agencies advise that you do so to combat fraud and identity theft. When you check your credit report, keep an eye out for anything unusual. For example, look for charges and accounts that you don’t recognize. This can be evidence that an identity thief has accessed your credit accounts or opened new accounts in your name.

2. Unexplained charges on your credit card accounts or bank statements

Similar to monitoring your credit, never pay your credit card bills without looking at the statement that comes with it. Make sure all the charges are yours. The same is true with your monthly bank statement. For example, check for any debit card purchases, withdrawals, or checks drawn that you yourself did not make.

3. Getting calls from debt collectors for accounts you never heard of

If you’ve always been diligent in paying your bills, take notice if you get a call from a debt collector. Such collectors could be calling about debts that you did not incur. The unpaid bill now in collection may belong to an identity thief. Unfortunately, your name is on the bill, and this can put you in to a world of hassles.

4. You have a legitimate medical insurance claim denied

Another sure sign that something is wrong, is if your health insurer rejects your legitimate medical claim because their records indicate that you’ve reached the limit of your benefits. This can happen if thieves have hacked your medical account, using up all your benefits so you can’t make a legitimate claim.

5. Unexplained medical bills, or inaccurate medical histories

Similar to the clue above, if a thief has gotten your health insurance information and used it to receive medical care, you might get a bill for health services you never received. You can also spot that you have been a victim of fraud if your medical records suddenly include a health condition that you don’t have. This could mean that a thief’s medical records have been mingled with your own, potentially damaging your ability to get the care that you need. If either of these things happen to you, be sure to contact your health insurance provider immediately.

Hackers can and do get into your accounts without your knowledge. Such data breaches can result in identity theft. However, the experts remind us that the most common source of identity theft is consumers unwittingly giving away their own info to thieves. Identity thieves use “phishing” email scams to trick consumers into sharing personal information such as Social Security numbers and other account numbers and passwords. Be careful about whom you provide information to online. Do not click on unfamiliar or potentially suspicious links.

Medicare, Social Security, or the IRS will NEVER call you or email you asking you to verify your account numbers or social security number.

If you are a victim of identity theft, file a report with the Federal Trade Commission at IdentityTheft.gov.

Have you or anyone you know been a victim of identity theft? Would you care to share the experience?