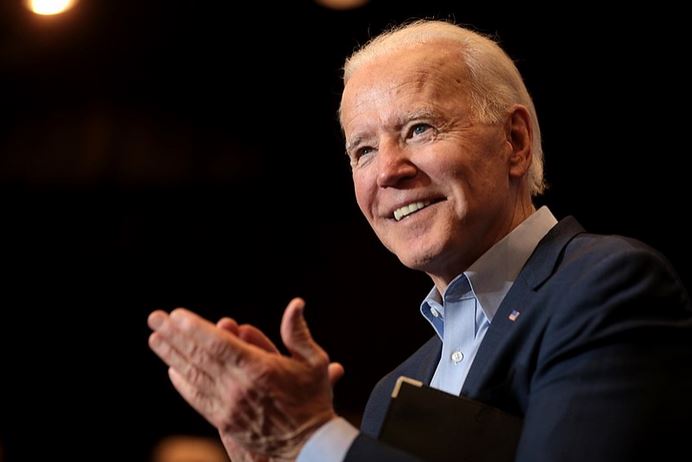

Regardless of how you feel about it, Joe Biden will be the 46th president of the United States. What exactly will Biden mean for your personal finances?

Of course, how much of the Biden-Harris economic agenda can actually be implemented relies a lot on Congress. Here are the top three ways that the financial experts think Biden will impact your personal finances.

1. Additional Covid-19 Stimulus Relief

Joe Biden and Kamala Harris made it clear on the campaign trail that they want another big stimulus package. Biden has been calling for more Covid-19 relief since as early as April, right after the CARES Act was passed when he outlined measures needed to be taken to support women during the Covid-19 crisis. Democrats have been furiously fighting for their HEROES Act (their attempt at a second stimulus bill) since it was first introduced in April. Since then, it has passed a pared-down version worth a still-whopping $2.2 trillion. It includes support for small businesses, improving the Paycheck Protection Program, providing state and local government funding, and sending another round of direct stimulus payments to Americans.

Biden’s “Build Back Better” plan includes calls for aid such as extending unemployment aid and implementing another Main Street relief package. It’s likely we will see these types of provisions included in the next stimulus package.

2. Healthcare

The Affordable Care Act (ACA) was a major pawn in the election. The Trump administration has tried since its inception to “repeal and replace” so-called Obamacare. A Supreme Court hearing will determine the ultimate fate of the ACA on November 10. If it survives the hearing, Biden has made it clear that he has big plans to “enhance” the law.

Under Biden’s ACA reform plan, dubbed “The Biden Plan to Protect & Build On the Affordable Care Act” (or, as he recently called it, “Bidencare”), the ACA will change in the following ways:

- There will be a new public health insurance option that will work similarly to Medicare.

- Tax credits to help afford insurance premiums will increase.

- The 400% income cap that determines eligibility for tax credits will be removed to help lower insurance premiums.

- Americans who are eligible for expanded Medicaid but live in the states that refused the expansion will be offered coverage.

- Individuals who have coverage from their employers will have the opportunity to turn down that coverage and enroll in a Marketplace plan.

However, these are bold proposals that will increase federal spending. The Committee for a Responsible Federal Budget’s high-cost estimate of Biden’s health plan adds $1.35 trillion to the deficit. We will see how Congress will receive these changes, considering the current federal deficit already sits at an all-time high of $3 trillion.

3. Taxes

The biggest concern over a Biden presidency is that he will have to raise taxes to pay for the above plans. He also has other plans on his financial agenda, which include significant changes intended to make college and retirement more affordable for more Americans. Biden promises to pay for this increased federal spending by raising taxes on the richest Americans, not the middle class.

According to Biden’s tax policy page on his campaign website, he will raise taxes on individuals making $400,000 or more. Additionally, big corporations will see their tax liabilities significantly increase. Biden will raise the corporate tax rate from 21% to 28%. Corporations that ship jobs overseas to sell products back to Americans (such as Apple) will face a tax penalty.

On the other hand, Biden promises everyday Americans tax relief. That includes expanding the Child Tax Credit for the duration of the coronavirus crisis. It would be $3,000 per child 6 to 17 years old and $3,600 per child under 6. The tax credit will also be available in monthly payments if families so choose, rather than a lump sum come tax time. Under Biden’s tax plan, he also promises child care, caregiving, and the restoration of first-time homebuyer tax credits.

Do you think a Joe Biden presidency will help or hurt your personal finances?