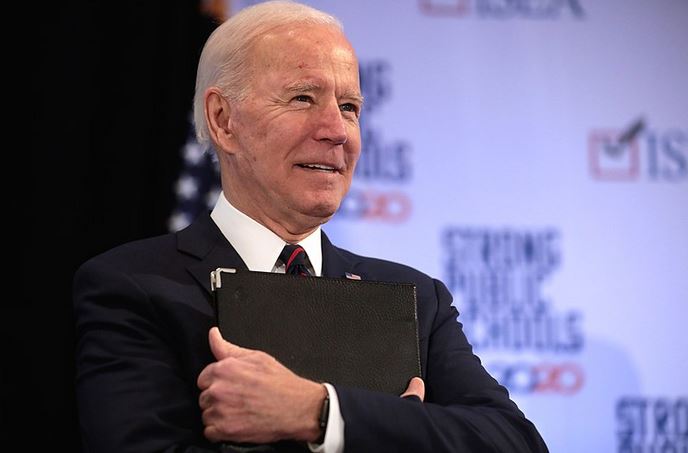

Joe Biden ran on a platform that he solidly built on appealing to the middle class and blue-collar workers. This was largely responsible for his rebuilding of the “blue wall,” and flipping the states of Pennsylvania, Wisconsin, and Michigan, that were responsible for his victory. Now that Biden will be the 46th president, that is good news for blue-collar America. But what will a Biden presidency mean to the wealthiest Americans?

Given what we already know about the Biden tax plan, we can expect that wealthy investors are going to have to revamp their long-standing strategies if they want to maintain wealth and minimize their tax obligations. High-income earners need only to look towards Biden’s own words to realize they need to rethink how they manage their portfolios.

“The fact is that we ought to start rewarding work, not just wealth,” Biden said in a February debate. He added that it’s “wrong” that billionaires pay lower rates on capital gains than employees do on their salaries.

According to a recent article in Bloomberg Wealth, Biden’s proposals will absolutely change how some money managers manage portfolios. According to Bloomberg, there are two main areas of concern for wealthy investors:

Stepped-Up Basis

- Especially painful would be the elimination of “stepped-up basis,” of estate valuations. The stepped-up basis is an obscure accounting rule. It wipes away taxable gains when property is passed down within a family from one generation to the next. The stepped-up basis has allowed rich families to almost never pay taxes on investment windfalls when properly passed down to their heirs. Biden has railed against the stepped-up basis since his time in the senate.

Rate on Capital Gains

- Investors may also be in for a much-higher rate on capital gains. When wealthy Americans sell stocks now, they pay a top rate of 23.8%. This includes 20% on capital gains and a 3.8% levy created by the 2010 Affordable Care Act. This is much less than the 37% top rate on ordinary income. Biden would end this lower rate on investors, while also boosting the top rate to 39.6%.

These and other aspects of the Biden tax plan to raise taxes on wealthy Americans — and fewer ways to avoid them — is prompting many rich Americans to radically reconsider their investment portfolios. This may help them to preserve their personal wealth, but it may also have impacts on the overall economy that are yet to be seen.

Do you think Joe Biden’s presidency will help or hurt your personal finances?