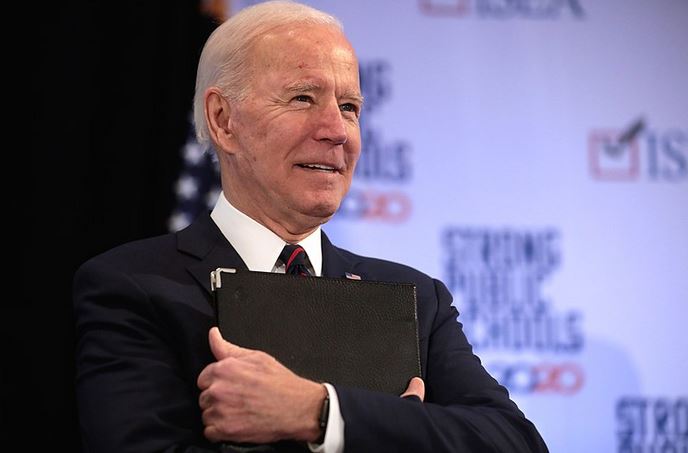

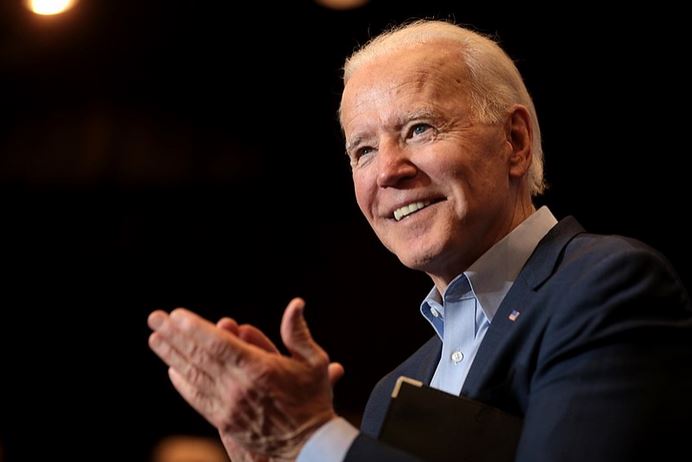

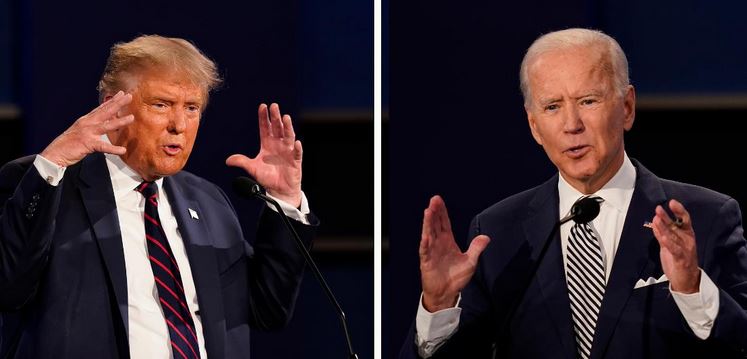

5 Ways the Biden Presidency Will Impact Your Personal Finances

On January 20, 2021, Joseph Robinette Biden Jr. will be sworn in as the 46th president of the United States. While this has had some people dancing in the streets, what exactly will a Biden presidency mean for your personal finances? Here are the top five ways that a Biden White House may impact your […]